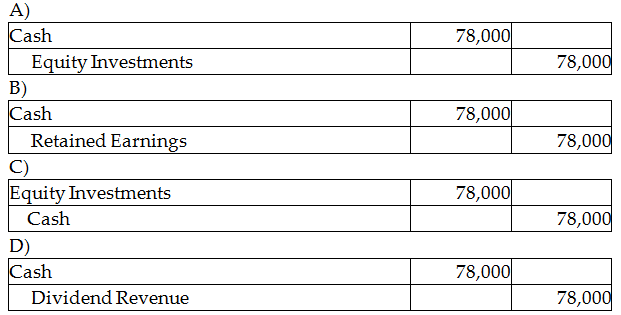

Gaines Corporation invested $114,000 to acquire 24,000 shares of Owens Technologies, Inc. on March 1, 2018. On July 2, 2019, Owens pays a cash dividend of $3.25 per share. The investment is classified as equity securities with no significant influence. Which of the following is the correct journal entry to record the transaction on July 2, 2019?

You might also like to view...

When interviewing, you want to come across as interested but not too eager. Discuss how to balance these goals

What will be an ideal response?

________ are a form of product that are essentially intangible

A) Innovations B) Services C) Brands D) Consumer products E) Supplements

Article 3 of the Uniform Commercial Code (UCC) governs the use of negotiable instruments

Indicate whether the statement is true or false

Which actions would Blair Kellison, CEO of Traditional Medicinals Inc., a California-based manufacturer of herbal medicines and teas, NOT typically consider in crafting his company's strategy of social responsibility?

A. actions that promote good stewardship (by protecting and enhancing) the environment B. actions to benefit Traditional Medicinals' shareholders such as raising the dividend or boosting the stock price C. making charitable contributions, supporting community service endeavors by Traditional Medicinals' employees, and reaching out to make a difference in the lives of the disadvantaged D. actions to enhance Traditional Medicinals' workforce diversity E. actions to ensure that Traditional Medicinals has an ethical strategy and operates honorably and ethically