Explain the probable incidence of a general sales tax imposed by a state

What will be an ideal response?

A general sales tax is borne by the consumer since there would be no opportunity to shift purchases from goods with the sales tax to those without it. The sales tax would raise the price of all products by the specified percentage and consumers would pay correspondingly higher prices that included the cost of the tax which is sent in by the retailer. The retailer might notice some slight diminution in overall sales as a result of consumers spending more of their disposable income in sales tax, but the effect on each individual retailer should be negligible.

You might also like to view...

If the government proposed a one-time tax of 25% on accumulated wealth, this would likely

A) reduce the incentive for individuals to accumulate wealth. B) increase the incentive for individuals to accumulate wealth. C) have no impact on individual accumulation of wealth since it is a one-time tax. D) All of the above are equally likely to happen.

Specialization is the result of:

A) hiring experienced workers. B) paying higher wages to experienced workers. C) workers developing a certain skill set. D) increased demand for a firm's commodity.

Refer to Table 4-5. An agricultural price floor is a price that the government guarantees farmers will receive for a particular crop. Suppose the federal government sets a price floor for wheat at $21 per bushel

a. What is the amount of shortage or surplus in the wheat market as result of the price floor? b. If the government agrees to purchase any surplus output at $21, how much will it cost the government? c. If the government buys all of the farmers' output at the floor price, how many bushels of wheat will it have to purchase and how much will it cost the government? d. Suppose the government buys up all of the farmers' output at the floor price and then sells the output to consumers at whatever price it can get. Under this scheme, what is the price at which the government will be able to sell off all of the output it had purchased from farmers? What is the revenue received from the government's sale? e. In this problem we have considered two government schemes: (1 ) a price floor is established and the government purchases any excess output and (2 ) the government buys all the farmers' output at the floor price and resells at whatever price it can get. Which scheme will taxpayers prefer? f. Consider again the two schemes. Which scheme will the farmers prefer? g. Consider again the two schemes. Which scheme will wheat buyers prefer?

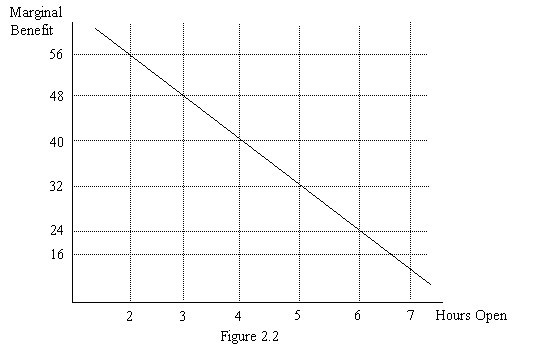

Joe runs a business and needs to decide how many hours to stay open. Figure 2.2 illustrates his marginal benefit of staying open for each additional hour. Suppose that Joe's marginal cost of staying open per hour is $24. How many hours should Joe stay open?

Joe runs a business and needs to decide how many hours to stay open. Figure 2.2 illustrates his marginal benefit of staying open for each additional hour. Suppose that Joe's marginal cost of staying open per hour is $24. How many hours should Joe stay open?

A. 3 hours B. 4 hours C. 5 hours D. 6 hours