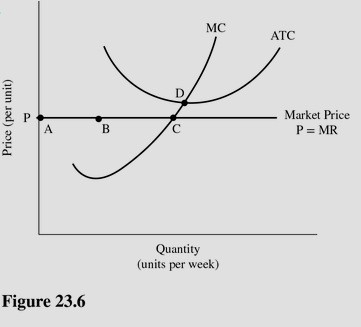

Refer to Figure 23.6 for a perfectly competitive firm. Given the current market price, we expect to see

Refer to Figure 23.6 for a perfectly competitive firm. Given the current market price, we expect to see

A. Exit from this industry.

B. Entry into this industry.

C. No change in the number of firms in this industry.

D. Costs rise to absorb the profits earned by the firms in the industry.

Answer: A

You might also like to view...

Suppose the capital gains tax is 28 percent and you purchased a house ten years ago for $80,000. If you sold the house today you would get $140,000. Your tax liability would be

A) $39,200. B) $16,800. C) indeterminate without knowing the inflation rate. D) indeterminate without knowing the personal income tax rate.

Which of the following is the most important protection against fears of bank collapse?

A. the Federal Reserve B. the Federal Reserve Open Market Committee C. the Federal Deposit Insurance Corporation D. the gold and silver that backs Federal Reserve notes

In which of the following ways does government affect the consumption component of planned aggregate expenditures?

What will be an ideal response?

If M2 were 3,000, small denomination time deposits were 300, and large denomination time deposits were 500, how much would M3 be?

Fill in the blank(s) with the appropriate word(s).