Which act identifies the U.S. taxpayers who hold financial assets in non-U.S. financial institutions and offshore accounts?

a. Foreign Account Tax Compliance Act

b. Foreign Corrupt Practices Act

c. U.S. Senate Bill Act

d. Basel II Tax Accord

a. Foreign Account Tax Compliance Act

Foreign Account Tax Compliance Act identifies U.S. taxpayers who hold financial assets in non-U.S. financial institutions and offshore accounts.This is done so that the taxpayers cannot avoid their U.S. tax obligations.

You might also like to view...

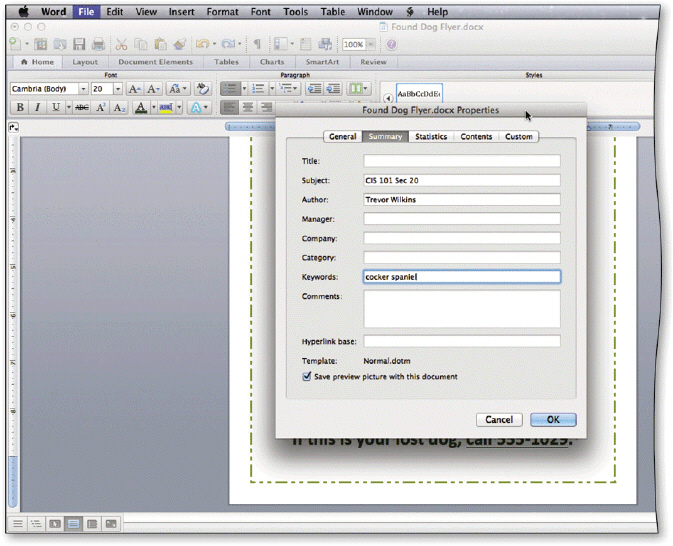

As shown in the accompanying figure, by creating consistent properties for files having similar content, users can better organize their documents.

As shown in the accompanying figure, by creating consistent properties for files having similar content, users can better organize their documents.

Answer the following statement true (T) or false (F)

A(n) ____________________ is a series of terms and their definitions.

Fill in the blank(s) with the appropriate word(s).

Which button turns on tracking?

A. Compare B. Manage Sources C. Track Changes D. Show Markup

Which of the following is considered a ‘cool' color?

A. gray B. green C. orange D. purple