Typically, when determining the appropriate audit procedures to perform for debt accounts, the auditor will usually decide to test debt obligations, including interest, using only substantive procedures

a. True

b. False

Indicate whether the statement is true or false

True

You might also like to view...

Data cleaning includes consistency checks and treatment of missing responses. The checks at this stage are less extensive than the checks made during editing

Indicate whether the statement is true or false

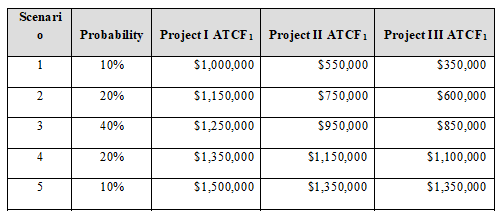

Powerful Wind, Inc. is a wind turbine manufacturer that is considering three investment projects: I, II, and III, that will cost $2,500,000, $2,300,000, and $3,700,000, respectively. The projects have an expected life of three, five, and seven years, correspondingly. The firm’s Vice President of Finance has estimated the probability distribution for each project’s first after-tax cash flow (ATCF1) as shown in the following table:

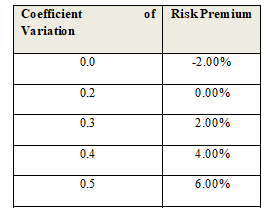

The Vice President of Finance uses the risk-adjusted discount technique to evaluate investment projects. He allocates risk premiums based on the coefficient of variation of each project’s after-tax cash flows according to the following table:

1. Each project’s after-tax cash flows are expected to grow at an annual rate of inflation of 3%.

a) Determine the expected cash flow, standard deviation, and coefficient of variation of each project in Year 1.

b) If the firm’s WACC is 15%, what is the appropriate risk-adjusted required rate of return of each project?

c) Using the appropriate discount rates, determine the payback period, discounted payback period, NPV, PI, IRR, and MIRR for each project.

d) If the projects are mutually exclusive, which project should be accepted? Answer the same question assuming they are independent projects.

6. Use the data of the previous problem to perform the following analysis:

a) Perform a sensitivity analysis using a Data Table. Determine the NPV, IRR, and PI as the ATCF1 takes on each possible outcome.

b) Determine the expected value and standard deviation of the NPVs, PI, and IRR of all projects.

c) Determine the coefficient of variation of the NPV, PI, and IRR of all projects.

d) Calculate the probability of a negative NPV, a PI less than one, and an IRR less than the required return for all projects.

e) Based on your results for parts (a), (b), (c), and (d), which project should be accepted?

Mia is meeting a potential customer to give a sales presentation and is concerned about what to wear. Which of the following would most likely enable Mia to convey a professional image?

A) brightly colored dress B) loose fitting shirt C) layers of jewelry D) scuffed shoes E) tailored skirt

Security is the determinant of service quality that means freedom from danger, risk, or doubt

Indicate whether the statement is true or false