When an entrepreneur invests his own financial capital in order to start a business

A) the opportunity cost of capital should be included in the economic cost of doing business.

B) the investment is treated as a fixed cost, so it should not be considered as a cost of doing business.

C) the firm's economic profits will exceed its accounting profits.

D) the accounting costs increase because the funds would otherwise have to be borrowed.

A

You might also like to view...

The wage premium for the average college graduate (vs. the average high school graduate) has gone down significantly in recent years

a. True b. False

Which of the following is an implication of the modern view of the Phillips curve?

a. Higher rates of inflation always lead to lower rates of unemployment. b. Higher rates of inflation always lead to higher rates of unemployment. c. If actual inflation exceeds the inflation rate anticipated by decision makers, unemployment will temporarily fall below the natural rate. d. If actual inflation exceeds the inflation rate anticipated by decision makers, unemployment will temporarily rise above the natural rate.

Which of the following tools help us evaluate how taxes affect economic well-being? (i) consumer surplus (ii) producer surplus (iii) tax revenue (iv) deadweight loss

a. (i) and (ii) only b. (i), (ii), and (iii) only c. (iii) and (iv) only d. (i), (ii), (iii), and (iv)

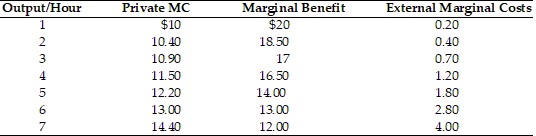

Use the above table. What will the price be when external costs are internalized with a tax?

Use the above table. What will the price be when external costs are internalized with a tax?

A. $13 B. $14 C. $12.20 D. $1.80