The ultimate distribution of a tax?s burden is the

A. tax structure.

B. tax base.

C. tax rate.

D. tax incidence.

Answer: D

You might also like to view...

In a market with positive externalities, the market equilibrium price will be less than the efficient equilibrium price

Indicate whether the statement is true or false

Between 1800 and 1940, the U.S. birthrate fell steadily. Factors contributing to this downward trend include:

a. urbanization. b. rising female employment. c. compulsory schooling d. declining infant mortality. e. all of the above.

Which of the following statements about inflation is correct?

a. Evidence from studies indicates that, in U.S. newspapers, inflation is mentioned less frequently than other economic terms, such as unemployment and productivity. b. People believe the inflation fallacy because they tend to believe too strongly in the principle of monetary neutrality. c. Nominal incomes are determined by nominal factors; they are not affected by real factors. d. Inflation does not in itself reduce people's real purchasing power.

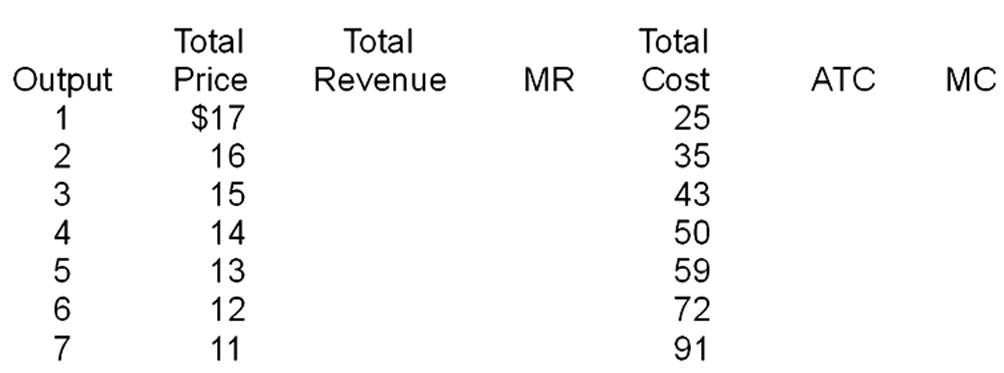

If the firm were a perfect competitor, how much would its price be in the long run?