The 2001 and 2003 tax cuts of the George W. Bush administration each had provisions to

A. lower the earned income tax credit.

B. raise tax rates at the upper end.

C. raise tax rates at the lower end.

D. increase (or speed up the already scheduled increase in) the child tax credit.

Answer: D

You might also like to view...

With an upward sloping LM curve, a rising interest rate __________ money demand, so that a contractionary monetary policy is __________ than in the case of a vertical LM curve

A) raises; stronger B) raises; weaker C) lowers; stronger D) lowers; weaker

In what way do public goods give rise to positive externalities?

Which one of the following was a basic economic conflict between the North and the South in the years preceding the Civil War?

A. The North opposed the high protective tariffs the South supported to protect its manufactured goods. B. The South opposed the high protective tariffs the North supported to protect its manufactured goods. C. The North demanded the abolition of slavery. D. The North opposed the building of a transcontinental railroad.

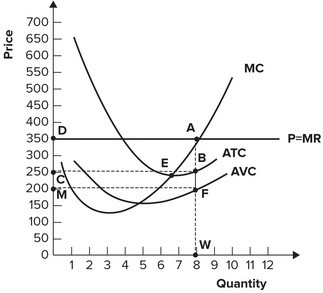

Refer to the graph shown. What level of output should the perfectly competitive firm produce to maximize profits?

A. 6. B. 4. C. 7. D. 8.