The progressive structure of the income-tax system is based on the:

A. Benefits-received principle

B. Principle of diminishing returns

C. Ability-to-pay principle

D. Principle that "taxes are the price we pay for civilization"

C. Ability-to-pay principle

You might also like to view...

The profit outcome achieved by setting MC = MR is the same as that achieved by setting TR = TC

Indicate whether the statement is true or false

An example of a real-life rule that might constrain people's behavior is:

A. having 24 hours in a day. B. the earth's limited supply of oil. C. minimum wage legislation. D. All of these are examples of real-life rules.

Discuss the determinants of the equilibrium interest rate. What can the Fed do to change the interest rate?

What will be an ideal response?

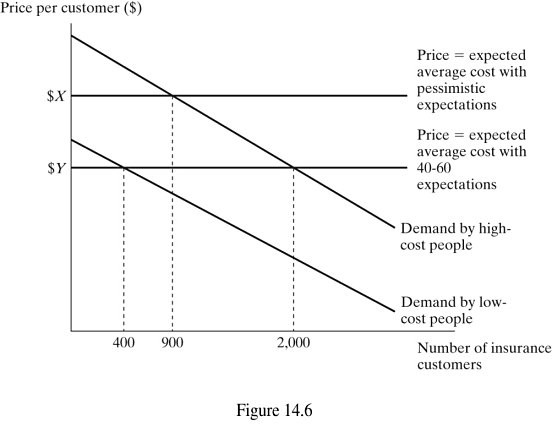

Figure 14.6 represents the market for health insurance. Suppose there are two types of consumers, low-cost consumers with $2,000 average medical expenses per year, and high-cost customers with $4,000 average medical expenses per year. If $Y is the price the insurance company would charge if it expected 40% of its customers to be high-cost, the price it would charge if it expected 50% of its customers to be high-cost would be:

Figure 14.6 represents the market for health insurance. Suppose there are two types of consumers, low-cost consumers with $2,000 average medical expenses per year, and high-cost customers with $4,000 average medical expenses per year. If $Y is the price the insurance company would charge if it expected 40% of its customers to be high-cost, the price it would charge if it expected 50% of its customers to be high-cost would be:

A. greater than $Y. B. less than $Y. C. equal to $Y. D. 50% of $Y.