In what ways is the Fed independent of the political process?

What will be an ideal response?

Board members are appointed for long, nonrenewable terms of office, reducing any one president's influence on the board's composition and reducing the temptation for governors to take actions merely to please the president and Congress. In addition, the Fed is financially independent.

You might also like to view...

Economists find that models based on the assumption of rational behavior are robust, because a world in which everyone is rational would function quite similarly to a world in which there are no

a. unexploited profit opportunities. b. constraints due to scarcity. c. inefficient markets. d. barriers to free trade.

Diversification

a. increases the likely fluctuation in a portfolio's return. Thus, the likely standard deviation of the portfolio's return is higher. b. increases the likely fluctuation in a portfolio's return. Thus, the likely standard deviation of the portfolio's return is lower. c. reduces the likely fluctuation in a portfolio's return. Thus, the likely standard deviation of the portfolio's return is higher. d. reduces the likely fluctuation in a portfolio's return. Thus, the likely standard deviation of the portfolio's return is lower.

YearSalaryCPI1969$20,52036.71979$43,26572.61989$85,529124.01999$135,250166.62009$170,844214.5Using the information in the table shown, what is the 1999 salary in 2009 dollars?

A. $174,136 B. $132,692 C. $170,844 D. $105,292

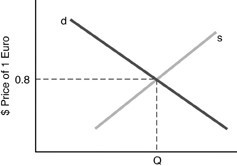

Use the above figure. A leftward shift in the demand curve, ceteris paribus, would result in

Use the above figure. A leftward shift in the demand curve, ceteris paribus, would result in

A. a euro appreciation. B. a dollar appreciation. C. increasing the equilibrium quantity of the euro. D. a dollar depreciation.