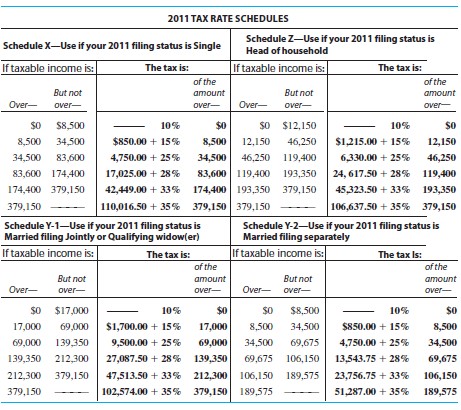

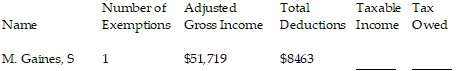

Find the amount of taxable income and the tax owed. The letter following the name indicates the marital status, and all married people are filing jointly. Use $3700 for each personal exemption; a standard deduction of $5800 for single people, $11,600 for married people filing jointly, $5800 for married people filing separately, and $8500 for head of a household; and the following tax rate schedule.

A. $39,556; $5508.40

B. $43,256; $6939.00

C. $39,556; $6014.00

D. $42,219; $6679.75

Answer: C

You might also like to view...

Rewrite the statement using the if...then connective. Rearrange the wording or words as necessary.All chocolate is good.

A. Chocolate is good. B. If it's good, then it's got to be chocolate. C. If it isn't chocolate, then it isn't good. D. If it's chocolate, then it's good.

Solve the problem.An investment broker invests $53,800 in small cap stocks and earns 15% per year on the investment. How much money is earned per year?

A. $358,667 B. $8070 C. $35,867 D. $80,700

Find the indicated term of the arithmetic sequence. ,

,  ,

,  , . . . ;16th term

, . . . ;16th term

A. 6

B.

C.

D.

Simplify. Assume that all variables represent positive numbers.

A. x + 4

B. x2 + 8x + 16

C. x + 2

D.  + 2

+ 2