What would be the amount of the unamortized acquisition differential on December 31, 2018?

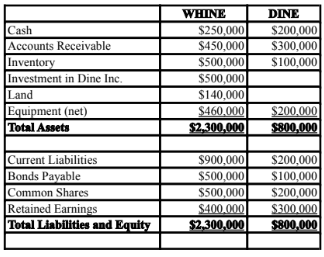

Whine purchased 80% of the outstanding voting shares of Dine Inc. on December 31, 2018. The balance sheets of both companies on that date are shown below (after Whine acquired the shares):

Also on December 31, 2018 (after the financial statements appearing above had been prepared) Chompster Inc., one of Whine's main competitors has agreed to acquire an equity interest in Dine Inc. As a result of the agreement, Dine Inc. would issue another 8,000 shares (over and above the 32,000 shares it currently has

outstanding) to Chompster for $20 per share.

The acquisition differential on the date of acquisition was attributed entirely to equipment, which had a remaining useful life of ten years from the date of acquisition.

Whine Inc. uses the equity method to account for its investment in Dine Inc. There were no unrealized intercompany profits on December 31, 2018.

A) $50,000. B) $80,000. C) $40,000. D) $125,000.

D) $125,000.

You might also like to view...

Federal judges of the U.S. district courts are appointed for 14-year terms.

Answer the following statement true (T) or false (F)

Accrual accounting is an application of the matching rule

Indicate whether the statement is true or false

The Food and Drug Administration (FDA) controls all package communications and labeling in the United States

Indicate whether the statement is true or false

Unfavorable variances are represented by debit balances in the overhead account

Indicate whether the statement is true or false