Sacha purchased land in 2010 for $35,000 that she held as a capital asset. This year, she contributed the land to the Boy Scouts of America (a charitable organization) for use as a site for a summer camp. The market value of the land at the date of contribution is $40,000. Sacha's adjusted gross income is $90,000. Assuming no special elections, Sacha's maximum deductible contribution this year is

A. $35,000.

B. $27,000.

C. $40,000.

D. $13,000.

Answer: B

You might also like to view...

Trey likes to drink Pepsi and will use a consumer promotion, such as a coupon or premium, only if it is for Pepsi. Trey is which type of consumer?

A) promotion prone B) brand loyal C) price sensitive D) shopper prone

On October 1, Lawrence Company borrowed $60,000 from Fourth National Bank on a 1-year, 7% note. If the company's fiscal year ends as of December 31, Lawrence should make an entry to increase

a. interest expense, $4,200. b. notes payable, $1,050. c. interest payable, $1,050. d. prepaid interest, $3,150.

If standard costing is not economically feasible for a company, predetermined overhead rates should not be used

Indicate whether the statement is true or false

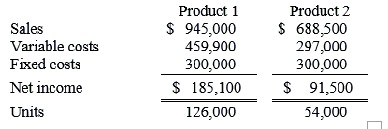

Next year's budget for Temper, Inc., is given below:  At the end of the year, the total fixed costs and the variable costs per unit were exactly as budgeted, but the following units per product line were sold:Product Line Units Sales 1 126,200 $958,579 2 56,800 $721,010 Required:(Be sure to indicate whether the variance is favorable or unfavorable.)a. Compute the sales activity variance for each product.b. Compute the sales mix variance for each product.c. Compute the sales quantity variance for each product.

At the end of the year, the total fixed costs and the variable costs per unit were exactly as budgeted, but the following units per product line were sold:Product Line Units Sales 1 126,200 $958,579 2 56,800 $721,010 Required:(Be sure to indicate whether the variance is favorable or unfavorable.)a. Compute the sales activity variance for each product.b. Compute the sales mix variance for each product.c. Compute the sales quantity variance for each product.

What will be an ideal response?