Lowering the discount rate is

A) a contractionary policy stance because the cost of borrowing funds falls, thereby encouraging consumption and investment spending.

B) a contractionary policy because it reduces banks' profit margins by lowering the return on lending.

C) an expansionary policy stance because consumers and businesses can now borrow funds directly from the Fed at a lower cost, thereby encouraging private spending.

D) an expansionary policy stance because it will be less costly for banks to borrow funds and this puts downward pressure on interest rates in the economy.

Answer: D) an expansionary policy stance because it will be less costly for banks to borrow funds and this puts downward pressure on interest rates in the economy.

You might also like to view...

The rate of technological progress is an important determinant of ________

A) long-run variation in economic growth B) long-run increases in interest rates C) short-run variation in employment rates D) short-run variation in economic growth

Refer to Figure 10.8. Other things equal, an increase in the demand for money and the accompanying change in the real interest rate would best be represented by

A) a movement from point A to point C. B) a movement from point A to point D. C) a shift from LM1 to LM2. D) a shift from LM2 to LM1.

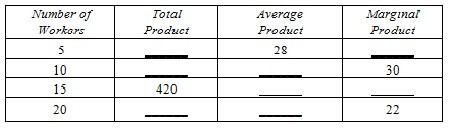

Given the table below, the maximum amount that can be produced using 20 workers is

A. 26.5 units. B. 442 units. C. 420 units. D. 22 units. E. 530 units.

Ford Motor Company announced a major rebate program for its cars and trucks. The rebate program amounts to a simple reduction in price. The company executives hope to increase revenue as a result of this rebate program. What economic explanation would

justify this decision? Please provide the best answer for the statement.