The price of mozzarella cheese, which is used in making pizza, increases. In the market for pizza you would expect that

A. the supply of pizza would increase and the price of pizza would decrease.

B. the demand for pizza would increase and the price of pizza would increase.

C. the supply of pizza would decrease and the price of pizza would increase.

D. the demand for pizza would decrease and the price of pizza would fall.

Answer: C

You might also like to view...

In general, the optimal amount of medical care is:

A. enough to stay healthy. B. the quantity at which the total cost of the care equals its total benefit. C. as much as one can afford. D. the quantity at which the marginal cost of the care equals its marginal benefit.

Regarding business conditions during the 1930s, which of the following events did not occur?

(a) The number of patents applied for declined. (b) The number of mergers between companies increased in an attempt to increase their consolidated strength. (c) Some interest rates, such as the prime rate, fell to less than 1%. (d) In the early years of the Depression, business investment spending on plants and equipment was not enough to increase or maintain the country's capital stock.

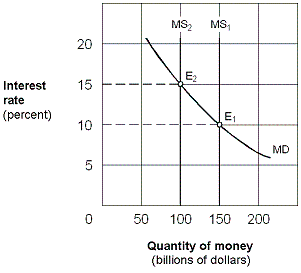

Exhibit 16-1 Money market demand and supply curves

A. higher investment, lower real GDP, and lower price level. B. lower investment, lower real GDP, and lower price level. C. higher investment, higher real GDP, and higher price level. D. higher interest rate and no effect on real GDP or the price level.

If one person earns $20,000 per year and another person earns $80,000 per year, they both will pay the Social Security tax __________.

A. at the same average tax rate B. but the poorer person will pay at a higher average tax rate C. but the richer person will pay at a higher average tax rate D. but it is impossible to calculate their individual average tax rates