Find the Social Security tax and Medicare tax on the annual gross income of a self-employed individual. For a self-employed person, the FICA rate is 12.4% and the Medicare rate is 2.9%. Round to the nearest cent if needed.Frank Weller, surveyor, earned $25,118.67

A. $1,557.36, $364.22

B. $3,014.72, $628.44

C. $3,114.72, $728.44

D. $1,557.36, $728.44

Answer: C

Mathematics

You might also like to view...

Evaluate the given integral by using three terms of the appropriate series, rounding the result to four decimal places.

A. 0.1216 B. 0.5877 C. 0.5620 D. 0.1801

Mathematics

Provide an appropriate response.Why is it not possible to have an alternating sequence that is an arithmetic sequence?

What will be an ideal response?

Mathematics

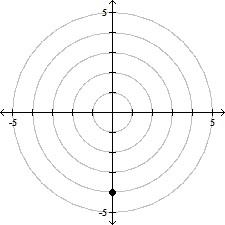

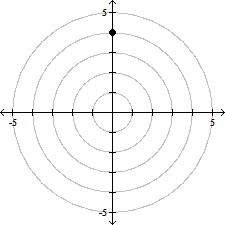

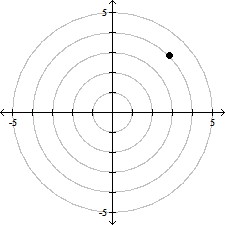

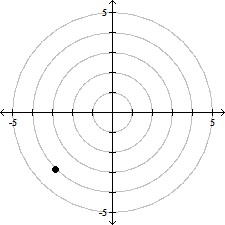

Plot the point given in polar coordinates.(4, 225°)

A.

B.

C.

D.

Mathematics

Provide an appropriate response.The only consecutive whole numbers that are both prime numbers are  and

and  .

.

A. 2 and 3 B. 1 and 2 C. 0 and 1 D. 6 and 7

Mathematics