Supply-side economists believe that a reduction in the tax rate

a. always decrease government tax revenue.

b. shifts the aggregate supply curve to the right.

c. provides no incentive for people to work more.

d. would decrease consumption.

b

You might also like to view...

The above table shows production points on Sweet-Tooth Land's production possibilities frontier. What is the opportunity cost of one chocolate bar if Sweet-tooth Land moves from point C to point D?

A) 30 cans of cola per chocolate bar B) 10 cans of cola per chocolate bar C) 3 cans of cola per chocolate bar D) 1/3 can of cola per chocolate bar

The federal funds rate is the interest rate on short-term loans made by:

A. the Federal Reserve to commercial banks. B. commercial banks to other commercial banks. C. the federal government to commercial banks. D. the Federal Reserve to the federal government.

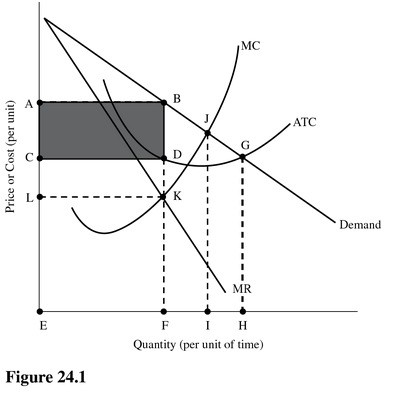

In Figure 24.1 total cost is represented by the area

In Figure 24.1 total cost is represented by the area

A. CDFE. B. ABFE. C. ABGHE. D. ABDC.

The barrier to entry protecting cable companies is primarily

A. network effects. B. economies of scale. C. ownership of a scarce factor of production. D. patents.