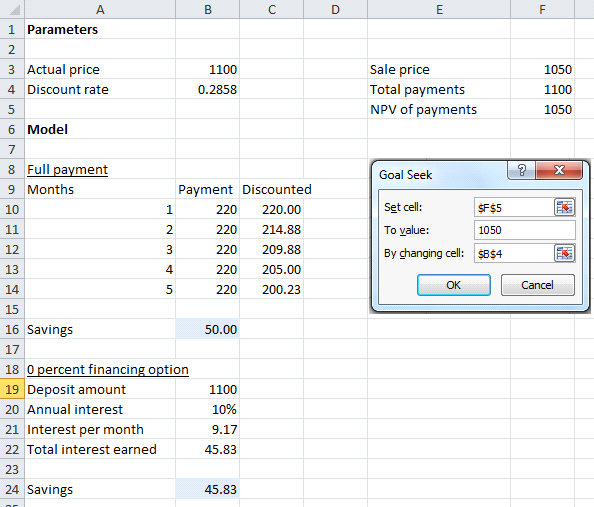

Suppose you have $1,100 and decide to purchase a new model of television that costs you $1,100. You find an electronics store where a gift voucher, worth $50, is offered for this TV model if payment is made in full at the time of purchase. Alternatively, it can be financed at zero-percent (0%) interest for 5 months with a monthly payment of $220. You now have two options: either opt for the zero-percent financing option for the full amount and invest your money at an annual interest rate of 10%; or choose the full-payment option with the $50 discount. Develop a spreadsheet model to find the better option that results in the most savings. Also, find the discount rate for the zero-percent financing option.

Hint: Use Goal Seek to find the discount rate that makes the net present value of the payments = $1,050.

?

What will be an ideal response?

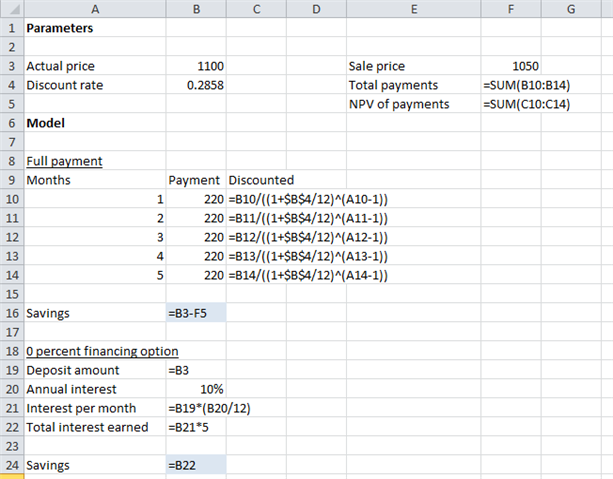

Key cell formulas:

The zero-percent interest option saves $45.83 whereas the full-payment option saves $50. Hence, it would be better if the full payment is made at the time of purchase.

The discount rate for the zero-percent financing option is 28.58%.

You might also like to view...

Age complexity involves children growing up at a younger age as well as older Americans wanting to act and feel younger than they are

Indicate whether the statement is true or false

The paid-in capital from sale of treasury stock account is debited if the sales price of the treasury stock sold is greater than its cost

Indicate whether the statement is true or false

A zero on one end of a relationship line indicates that there may be none of the entity that the line is connected to

Indicate whether the statement is true or false

Risk is the uncertainty about the return we will earn.

Answer the following statement true (T) or false (F)