Big Woods is a lumber firm that sells plywood sheets to local builders. If the annual holding cost of a sheet of plywood is $8 and the managers of Big Woods order 700 sheets of plywood, what is the total annual carrying costs of the inventory?

A) $2,800

B) $5,600

C) $2,000

D) $6,000

A) $2,800

You might also like to view...

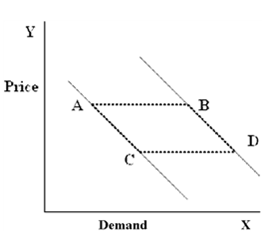

Figure 4-23

A. A to C B. C to A C. B to D D. B to A

The demand for loanable funds curve slopes downward because the

A) expected rate of profit is related positively to the real interest rate. B) real interest rate is the opportunity cost of investment. C) price of bonds and stocks is not related to the real interest rate. D) higher the real interest rate, the lower the cost of investment. E) expected rate of profit is factor that "rewards" firms for their investment.

With fixed exchange rates, the adjustment to changes in international monetary conditions comes through

A) exchange rate changes. B) exchange rate changes and international money flows. C) international money flows. D) None of the above.

The Laffer curve expresses a relationship between:

a. tax rates and tax revenues. b. inflation and unemployment. c. interest rates and saving. d. money supply and the price level.