Suppose, after undergoing genetic testing, you discover that you have a health condition that could result in the emergence of a disability which would make it impossible for you to continue to work. The probability of this happening is 50%. Currently your expected lifetime earnings are $5,000,000, but if the disability hits, your expected lifetime earnings will consist primarily of income earned from government support programs -- and will not add up to more than $1 million.

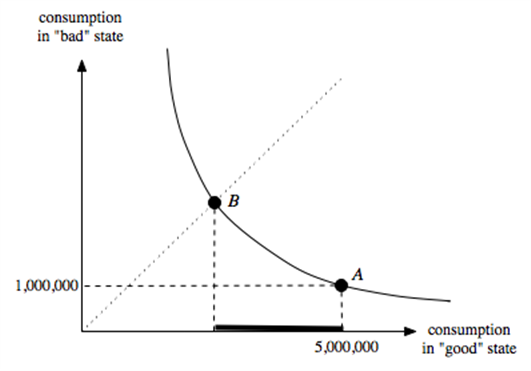

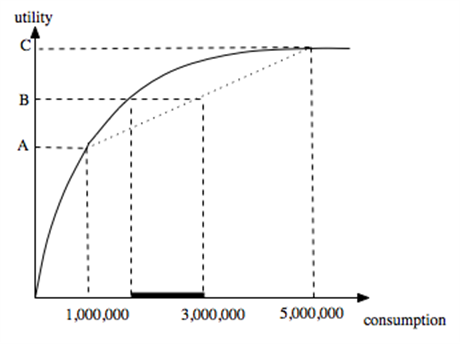

a. Suppose that you are risk averse and your tastes are state-independent. Illustrate your expected utility in a graph with lifetime consumption on the horizontal and utility on the vertical axis.

b. Illustrate how much you would be willing to pay for full insurance.

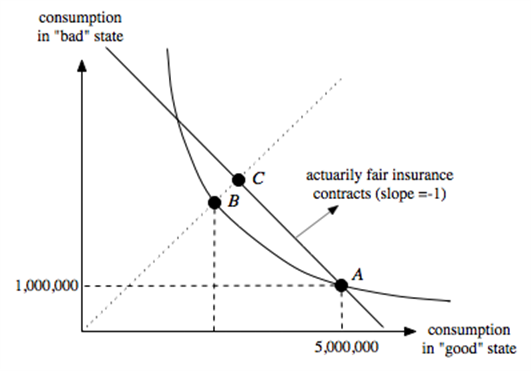

c. Illustrate what you showed in (b) in a

different graph that has consumption in the "good" state on the horizontal and consumption in the "bad" state on the vertical.

d. What would a full menu of actuarily fair insurance contracts look like in your graph from part (c)? Where would you optimize in that graph?

e. Now suppose that you believe consumption will be more meaningful if the health condition does not materialize. What changes in your graph from part (d)?

What will be an ideal response?

b. The most you would be willing to pay for full insurance is an amount that results in a consumption level that gives the same utility as the expected utility B without insurance. This amount is indicated by the darkened horizontal line segment in the graph above.

c. This is illustrated in the graph below.

d. The actuarily fair insurance contracts lie on a line through A with slope -1 (as shown below). You would optimize at C with full insurance.

e. The only thing that changes is the "MRS" of the indifference curves -- it becomes steeper, implying you will no longer fully insure when offered a full menu of actuarily fair insurance contracts.

You might also like to view...

If the price elasticity of demand for smart watches is 1.4 (dropping the minus sign), then a 50 percent increase in the price of smart watches will lead to

A. the sale of 200 additional smart watches. B. the sale of 125 percent fewer smart watches than before. C. the sale of 70 percent fewer smart watches than before. D. the sale of 25 percent fewer smart watches than before.

Many people have observed that retail gas stations tend to operate very closely to one another. Explain the logic behind having a gas station at each corner of an intersection

What will be an ideal response?

Why does the free-rider problem occur in the debt market?

What will be an ideal response?

Consider a car dealership advertises a three-year lease at $250 per month. When you arrive to apply, you discover that the lease requires a downpayment of $3600 dollars. You will undertake the lease if

A) you value the lease at least $350 per month. B) you value the lease at least $250 per month, the $3600 is a sunk cost. C) you value the lease less than $350 per month. D) you value buying a new car at $400 per month.