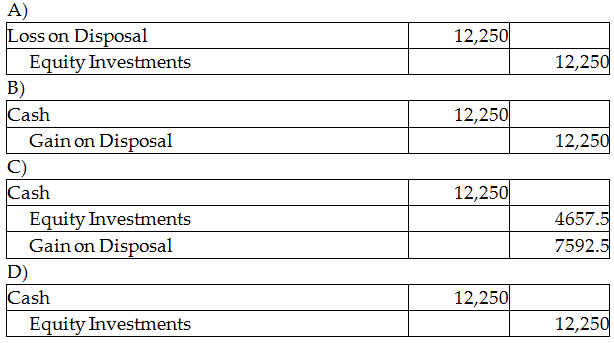

Westbrook Financial Services, Inc. invested $15,000 to acquire 7250 shares of Cloud Investments, Inc. on March 15, 2015. This investment represents less than 20% of the investee's voting stock. On May 7, 2018, Westbrook Financial Services, Inc. sells 2250 shares for $12,250. Which of the following will be the correct journal entry for the May 7, 2018 transaction? (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.)

Explanation: Total cost of 2250 shares at the purchase time $4657.5

(2250 shares × $2.07)

Total value of 2250 shares at the selling time 12,250

Gain on Disposal $7592.5

You might also like to view...

Comparing one company with another in the same industry should cause no problems since companies in the same industry are required to use the same GAAP

a. True b. False Indicate whether the statement is true or false

Stare decisis:

A. creates harsh results by refusing to recognize equitable exceptions. B. means a new statute applies only to actions taken after it becomes effective. C. renders law rigid and unchanging. D. lends predictability to decisional law by relying on prior decisions.

Explain the three perspectives of organizational culture that may enhance economic performance. Which perspective was found to provide the highest level of long-term financial performance?

What will be an ideal response?

Which three supplier types should be examined in an environmental forecast?

a. land, labor, and capital b. resources, labor, and capital c. raw materials, finances, and entrepreneurship d. equity, assets, and perishables