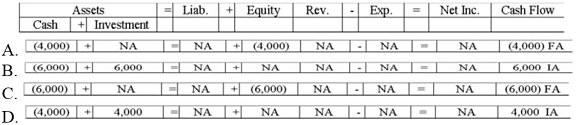

Kellogg, Inc. purchased 200 shares of its own $20 par value stock for $30 cash per share. Which of the following answers reflects how this purchase of treasury stock would affect Kellogg's financial statements?

A. Choice A

B. Choice B

C. Choice C

D. Choice D

Answer: C

You might also like to view...

Which of the following is a necessary part of being an ethical business leader?

A. Achieving goals through threats, intimidation, harassment, and coercion B. Creating a corporate culture in which employees are empowered and expected to make ethically responsible decisions C. Refraining from placing her or his own ethical behavior above any other consideration D. Guiding, directing, and escorting followers to their common destination, even if it means employing unfair methods

SFAS No. 130 allows all but which of the following regarding comprehensive income?

a. Reporting comprehensive income in a combined statement of financial performance b. Reporting comprehensive income in a separate statement of comprehensive income which would begin with net income c. Reporting comprehensive income within a statement of changes in equity d. Not reporting comprehensive income

A(n) ________ is an actual piece of paper, such as a warehouse receipt or bill of lading, which is required in some transactions of pickup and delivery of sold goods

A) destination contract B) letter of credit C) document of title D) acceptance draft

A worker who requires the assistance of a service dog

a. cannot be employed in many places. b. will need to work in an isolated area. c. will be accommodated and the workplace will be accessible. d. all of these choices.