Which of the following would NOT be directly included in the U.S. GDP in 2010?

A) the purchase of a new home in Atlanta, Georgia in 2010

B) the market value of the jet fuel bought by Delta to use for its flights in 2010

C) the market value of restaurant meals sold in 2010

D) the value of the automobiles produced in 2010 at the Toyota plant located in Georgetown, Kentucky

E) legal services provided to first time home buyers during 2010

B

You might also like to view...

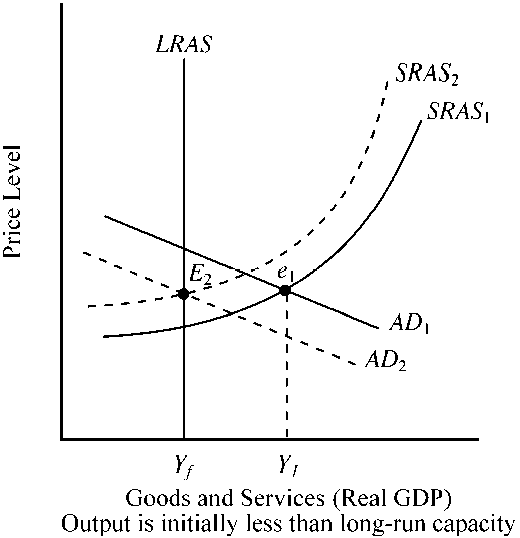

Figure 10-17

Suppose an economy is currently operating at output Y1 associated with AD1 and SRAS1, shown in . Initially, the output of this economy is

a.

above its potential, and the rate of unemployment is greater than the natural rate.

b.

below its potential, and the rate of unemployment is greater than the natural rate.

c.

above its potential, and the rate of unemployment is less than the natural rate.

d.

below its potential, and the rate of unemployment is less than the natural rate.

The term opportunity cost refers to the

A. Amount of resources used to produce a good but not a service. B. The most desired good or service given up when something is obtained. C. Financial costs of all the factors of production used to produce a good or service. D. Value of every other good given up when a good or service is obtained.

There is no long-run trade-off between inflation and unemployment.

Answer the following statement true (T) or false (F)

The ability of the Federal Reserve to use monetary policy to affect economic variables such as real GDP ultimately depends upon its ability to affect

A) tax rates. B) real interest rates. C) nominal interest rates. D) foreign exchange rates.