Everest Corp. acquires a machine (seven-year property) on January 10, 2018 at a cost of $2,512,000. Everest makes the election to expense the maximum amount under Sec. 179, and bonus depreciation is not claimed.

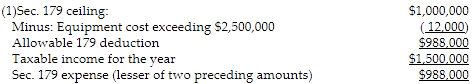

a. Assume that the taxable income from trade or business is $1,500,000.

(1) What is the amount of the Sec. 179 expensing deduction for the current year?

(2) What is the amount of the Sec. 179 carryover to the next tax year?

(3) What is the amount of depreciation allowed?

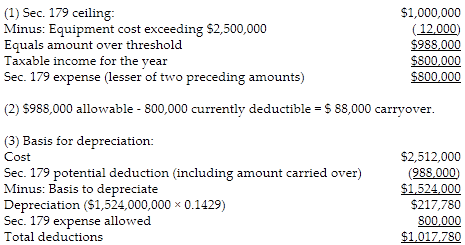

b. Assume instead that the taxable income from trade or business is $800,000.

(1) What is the amount of the Sec. 179 expensing deduction for the current year?

(2) What is the amount of the Sec. 179 carryover to the next tax year?

(3) What is the amount of depreciation allowed this year?

a.

2) None. There is no carryover because there was no taxable income limitation.

(3) Basis for depreciation:

b.

You might also like to view...

When faced with a network design decision, the goal of a manager is to design a network that minimizes the firm's costs while satisfying customer needs in terms of demand and responsiveness

Indicate whether the statement is true or false.

Refer to the table. Which cell(s) would be designated as the "Forecast cell"?

A) A5 B) B2 C) B3 D) B4 E) B5

Automobile insurance plans, also known as assigned risk plans, are designed to give discounts to good drivers who have had no insurance claims or motor vehicle tickets for at least three years

Indicate whether the statement is true or false

A firm has $300 million of assets that includes $60 million of cash and 8 million shares outstanding. If the firm uses $30 million of its cash to repurchase shares, what is the new price per share?

A) $37.50 B) $30.00 C) $45.00 D) $52.50