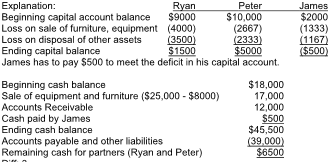

Ryan, Peter, and James share profits 3:2:1. They liquidate the partnership. The furniture and equipment are sold at a $8000 loss. The accounts receivable were collected in full and the other assets were written off as worthless. The liabilities were paid off at book value. James argued that he should receive a portion of the remaining cash, but Ryan and Peter disagree. How much cash should James receive or pay?

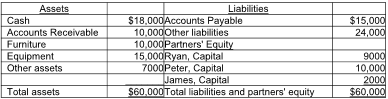

The balance sheet of Ryan, James and Peter's partnership as of December 31, 2018, is given below.

A) He should receive $1500.

B) He should not receive or pay any money.

C) He should pay $55,500.

D) He should pay $500.

D) He should pay $500.

You might also like to view...

All of the following statements about current liabilities are true except:

a. Current liabilities are obligations which will be satisfied within one year. b. Current liabilities are normally recorded at face value . c. The current liability section never contains any portion of long-term liabilities. d. Current liabilities finance the working capital of the company.

Marketers are particularly interested in segmenting older Americans because they typically have two things that most of their younger counterparts do not: time and ________.

Fill in the blank(s) with the appropriate word(s).

Justin and Nicole are forming a partnership. What are some of the factors they should consider in deciding how income might be divided?

To understand how well an economic system is doing, which of the following measurements is utilized?

a. profit b. gross domestic product c. market share d. the volume of the product produced e. unemployment