CPA Firm A has performed most of the audit of Consolidated Company's financial statements and qualifies as the group auditor. CPA Firm B did the remainder of the work. Firm A wishes to assume full responsibility for Firm B's work. Which of the following statements is correct?

A. Such assumption of responsibility violates the profession's standards.

B. In such circumstances, when appropriate requirements have been met, Firm A should issue an unmodified opinion on the financial statements but should make appropriate reference to Firm B in the audit report.

C. In such circumstances, when appropriate requirements have been met, Firm A should issue a standard unmodified opinion on the financial statements.

D. CPA firm A should normally qualify its audit report on the basis of the scope limitation involved when another CPA firm is involved.

Answer: C

You might also like to view...

Which of the following is not a rule of netiquette?

A) Use emoticons wherever possible. B) Be professional. C) Avoid yelling. D) Be courteous.

Describe at least four different types of budgets that are frequently used.

What will be an ideal response?

What is the legal consequence of a trademark becoming a generic term?

A) The fair use doctrine would not apply. B) No one can use the term in a name for that type of product. C) The holder of the trademark for the term that has become generic cannot prevent others from using the generic term. D) Every seller must use the term to describe that type of product.

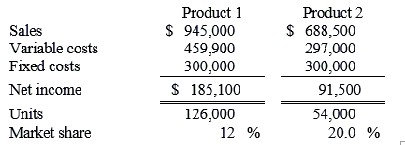

Next year's budget for Alton, Inc., is given below:  At the end of the year, the total fixed costs and the variable costs per unit were exactly as budgeted, but the following units per product line were sold:Product Line Units Sales Mkt share1 126,200 $958,579 16.0%2 56,800 $721,010 14.2%Required:(Be sure to indicate whether the variance is favorable or unfavorable.)a. Compute the sales activity variance for each product.b. Compute the market share variance for each product.c. Compute the industry volume variance for each product.

At the end of the year, the total fixed costs and the variable costs per unit were exactly as budgeted, but the following units per product line were sold:Product Line Units Sales Mkt share1 126,200 $958,579 16.0%2 56,800 $721,010 14.2%Required:(Be sure to indicate whether the variance is favorable or unfavorable.)a. Compute the sales activity variance for each product.b. Compute the market share variance for each product.c. Compute the industry volume variance for each product.

What will be an ideal response?