Economists have shown that the burden of a tax is

A) greater on the buyer when the tax is collected from the seller and greater on the seller when the tax is collected from the buyer.

B) the same whether the tax is collected from the buyer or the seller.

C) greater on the buyer when the tax is collected from the buyer.

D) greater on the seller when the tax is collected from the seller.

B

You might also like to view...

If Dr. Giltscalpel's gross revenue doubled when he doubled his surgical fees, the demand for his services within the relevant price range would be

A) indeterminate. B) perfectly elastic. C) perfectly inelastic. D) unit elastic. E) none of the above.

Explain the difference between the following two expressions: Y = C(Yd) + I + G + CA(EP /P, Yd) and Y = C + I +G + CA

What will be an ideal response?

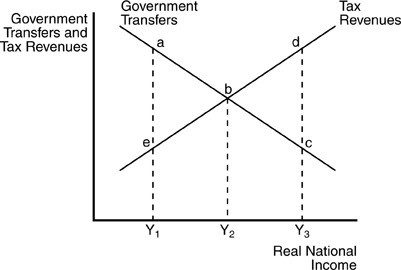

Refer to the above figure. A budget deficit occurs when real national income is

Refer to the above figure. A budget deficit occurs when real national income is

A. Y3. B. Y1. C. Y2. D. None of these: cannot be determined given the information.

Dr. Goldfinger decides to invest in companies which he believes can "improve the productivity and efficiency" of health care services. What would Dr. Goldfinger need to do to try to achieve allocative efficiency?

A) invest in companies that produce goods and services based on consumer preferences B) invest in companies that produce goods and services at the lowest possible cost C) invest in companies that fairly distribute their products and services D) invest in companies that produce up to the point where the marginal cost of the last unit produced is zero