As the unemployment rate decreases in response to the economy moving toward capacity output, the aggregate price level

A. falls at an increasing rate.

B. is stable.

C. rises.

D. falls at a declining rate.

Answer: C

You might also like to view...

When demand is perfectly inelastic with respect to price, the demand curve is horizontal

Indicate whether the statement is true or false

In the figure above, the price of bonds would fall from P1 to P2 when

A) inflation is expected to increase in the future. B) interest rates are expected to fall in the future. C) the expected return on bonds relative to other assets is expected to increase in the future. D) the riskiness of bonds falls relative to other assets.

Suppose there's an 80% chance of a stock rising by 20% and a 20% chance of it falling by 40%. Which type of investor would prefer an investment with a guaranteed return of 5%?

A) risk loving investor B) risk neutral investor C) risk averse investor D) risk is not relevant in this example

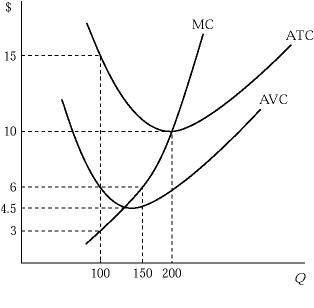

Figure 9.3Figure 9.3 shows the cost structure of a firm in a perfectly competitive market. Assume the market price is $3 and the firm is currently producing 100 units. If the firm produces zero units in the short run, it will reduce its economic loss by:

Figure 9.3Figure 9.3 shows the cost structure of a firm in a perfectly competitive market. Assume the market price is $3 and the firm is currently producing 100 units. If the firm produces zero units in the short run, it will reduce its economic loss by:

A. $300. B. $600. C. $900. D. $1,200.