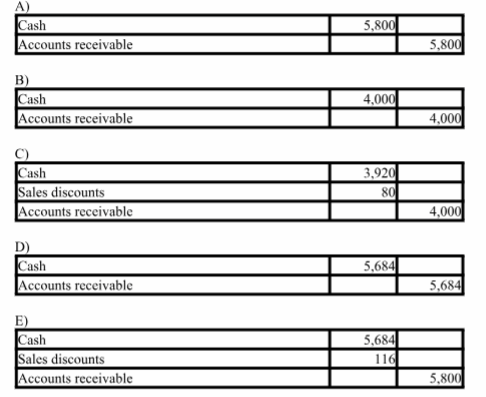

On September 12, Vander Company sold merchandise in the amount of $5,800 to Jepson Company, with credit terms of 2/10, n/30. The cost of the items sold is $4,000. Vander uses the periodic inventory system and the gross method of accounting for sales. Jepson pays the invoice on September 18, and takes the appropriate discount. The journal entry that Vander makes on September 18 is:

You might also like to view...

Bonds Payable has a balance of $1,000,000 and Discount on Bonds Payable has a balance of $15,500 . If theissuing corporation redeems the bonds at 98.5, what is the amount of gain or loss on redemption?

a. $500 loss b. $15,500 loss c. $15,500 gain d. $500 gain

Which of the following was NOT discussed as a way that "Online data collection has profoundly changed the marketing research landscape, particularly in the case of online panels"?

A) Company managers can retrieve tabulated customer reactions on a daily basis. B) Online surveys are generally believed to effect response quality equal to telephone or mail surveys. C) Because the researcher can monitor the progress of the online survey on a continual basis, it is possible to spot problems with the survey and to make adjustments to correct these problems. D) The speed, convenience, and flexibility of online surveys make them very attractive. E) Online questionnaires afford a great deal of control to marketing researchers, normally with the survey being self-administered.

Which of the following are internal communication duties performed by public relations professionals?

A) coordinating relationships with media for news coverage B) reaching personnel through the intranet, newsletters, and meetings to convey company news C) coordinating relationships with outside specialty groups such as graphic services D) coordinating activities with regulatory agencies concerned about employee safety

To perform a vertical analysis of an income statement, you would divide each line item on the statement by:

A. net income. B. operating expenses. C. sales. D. cost of goods sold.