Kanzler Corporation is considering a capital budgeting project that would require an initial investment of $450,000 and working capital of $25,000. The working capital would be released for use elsewhere at the end of the project in 4 years. The investment would generate annual cash inflows of $143,000 for the life of the project. At the end of the project, equipment that had been used in the project could be sold for $10,000. The company's discount rate is 14%. The net present value of the project is closest to:See separate Exhibit 13B-1 and Exhibit 13B-2, to determine the appropriate discount factor(s) using the tables provided.

A. $(52,521)

B. $(37,721)

C. $132,000

D. $(27,521)

Answer: B

You might also like to view...

The minimum transfer price is the transfer price that would leave the selling division no worse off if the good is sold to an internal division

Indicate whether the statement is true or false

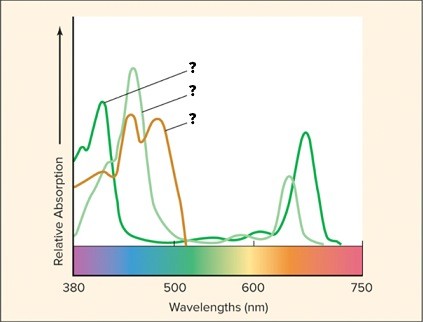

Use the data provided to identify the lines on the graph as the absorption spectrums of chlorophyll a, chlorophyll b, and the carotenoids.Max. absorption of chlorophyll a-430 & 662 nmMax. absorption of chlorophyll b-453 & 642 nmMax. absorption of carotenoids-bimodal; approx. 450 & 490 nm

What will be an ideal response?

Accounts Receivable is an asset that is considered nonmonetary in nature

Indicate whether the statement is true or false

Formal authority ______.

a. arises from the patterns of relationships and communication that evolve as employees interact and communicate b. is always more effective than informal authority c. is the unsanctioned way of getting things accomplished d. is based on the specified relationships among employees