Assume Joe invests a total of $10,000 in a company—$5,000 of which is his own money and $5,000 of which he borrowed at a 10 percent interest rate. If the company’s stock value increases by 20 percent in one year at which time Joe sells his shares of the stock, what is Joe’s rate of return on his investment?

A. 10 percent

B. 15 percent

C. 20 percent

D. 30 percent

Answer: D

You might also like to view...

If consumer incomes go up and cars are a normal good, the effect on the demand for cars ceteris paribus, will be a(n):

a. upward movement along the demand curve for cars. b. downward movement along the demand curve for cars. c. rightward shift in the demand curve for cars. d. leftward shift in the demand curve for cars.

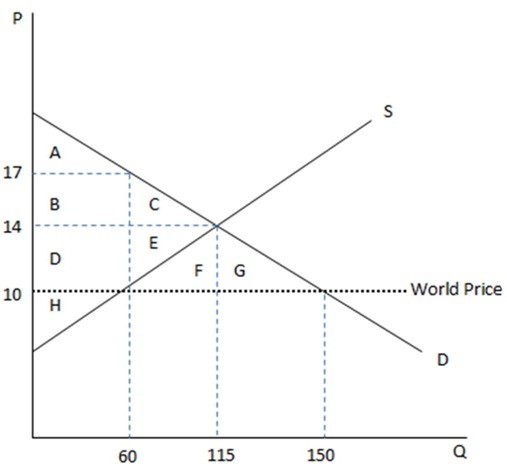

This graph demonstrates the domestic demand and supply for a good, as well as the world price for that good. According to the graph shown, if this economy were open to free trade, domestic consumers would consume how many units?

According to the graph shown, if this economy were open to free trade, domestic consumers would consume how many units?

A. 115 B. 90 C. 60 D. 150

Which of the following is an INCORRECT statement about predatory pricing?

A. Having its prey stockpile its product produces more benefits to the firm engaging in the predatory pricing. B. Reputation for taking tough actions to drive a competitor out of the market can enhance the benefits received from the firm engaging in the predatory pricing. C. It benefits the firm engaging in predatory pricing to have deeper pockets than its prey. D. None of the statements are correct.

The monopolist's marginal revenue is less than price since

A. the demand function is horizontal. B. additional units can only be sold if the price is lowered on all units sold. C. average total cost is declining. D. average revenue is also less than price.