Assume a family that earns $20,000 pays $2,000 in income taxes, while a family that earns $40,000 pays $3,000 in income taxes. In this situation, the income tax system is

A) progressive.

B) regressive.

C) proportional.

D) one of the above but we cannot tell which one without more information.

Answer: B

You might also like to view...

By the time Paul Volcker took office as the new Federal Reserve chairman in 1979, the inflation rate exceeded 10%. By the end of 1986 the inflation rate had been brought down to 1.9%. Which of the following is true about the Volcker Disinflation?

A) lower inflation resulted from a tightening of monetary policy B) by raising the federal funds rate to over 20%, the Federal Reserve stimulated the economy resulting in lower levels of both inflation and the unemployment rate by the early 1980s C) the unemployment rate was brought down by 1982 but it took longer to reach lower inflation rates D) all of the above E) none of the above

In the long run, if the output of a firm is zero then its total cost will be equal to its total fixed cost

a. True b. False Indicate whether the statement is true or false

The purchase of a new house is the one form of

a. investment that is financed by private saving rather than public saving. b. household spending that is not counted as part of investment in the national income accounts. c. household spending that is investment rather than consumption. d. household spending that does not contribute to GDP.

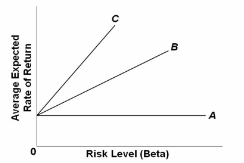

Refer to the graph. Which of the three Security Market Lines would represent a situation where investors do not care about the risk level of a financial asset?

A. Line A.

B. Line B.

C. Line C.

D. None of these.