If the nominal interest rate on a one-year loan was 7%, the actual inflation rate over the year was 3% and the expected inflation rate over the year was 2.5%, then the expected real interest rate equals

A. 3.75%.

B. 3.5%.

C. 4.5%.

D. 4.0%.

Answer: C

You might also like to view...

Consider two economies: A and B. The nominal interest rate is the same in both economies, but the rate of inflation is higher in economy B. Which of the following statements will then be true?

A) The real interest rate will be the same in both economies. B) The real interest rate will be higher in economy B. C) The real interest rate will be higher in economy A. D) Whether the real interest rate is higher in economy A or B will depend on the number of borrowers in both economies.

The inverse demand in a Cournot duopoly is P = a ? b(Q1 + Q2), and costs are C1(Q1) = c1Q1 and C2(Q2) = c2Q2. The government has imposed a per-unit tax of $t on each unit sold by each firm. The equilibrium output of each firm is the same as a situation where each firm's:

A. demand increases by t. B. marginal cost decreases by t. C. demand decreases by t. D. marginal cost increases by t.

A decrease in aggregate supply means:

A. both the real domestic output and rises in the price level would become greater. B. the real domestic output would increase and rises in the price level would become smaller. C. the real domestic output would decrease and the price level would rise. D. both the real domestic output and the price level would decrease.

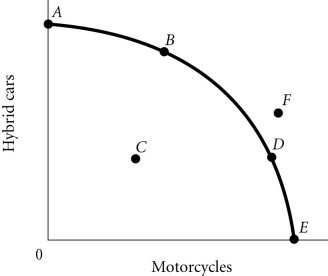

Refer to the information provided in Figure 2.4 below to answer the question(s) that follow. Figure 2.4According to Figure 2.4, as the economy moves from Point B to Point D, the opportunity cost of motorcycles, measured in terms of hybrid cars,

Figure 2.4According to Figure 2.4, as the economy moves from Point B to Point D, the opportunity cost of motorcycles, measured in terms of hybrid cars,

A. increases B. remains constant. C. initially increases, then decreases. D. decreases.