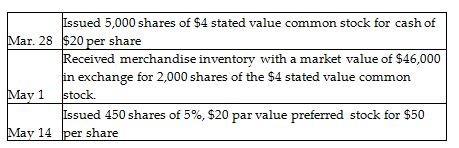

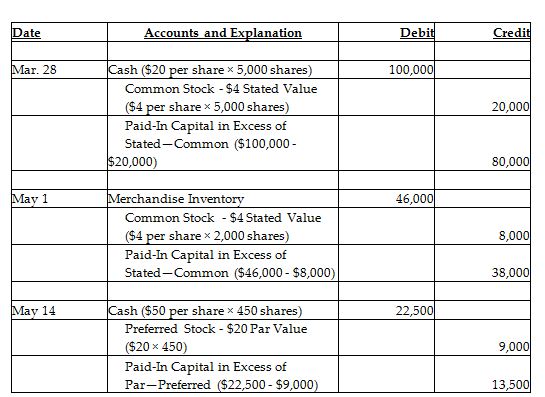

Budget Office Supply Corporation completed the following stock issuance transactions:

Prepare the journal entries to record these transactions. Explanations are not required.

You might also like to view...

Bank reconciliations should be performed by the individual who makes bank deposits

a. True b. False Indicate whether the statement is true or false

The best presentation messages will _____ for the audience

A) inspire action B) provide information C) clarify difficult concepts D) answer a question E) save time

Malcolm Obrien was asked by Theresa Cho to be a director of her company. Malcolm agreed, but apart from accepting the title of director he had no idea what was going on in the business. There were never any formal board of directors meetings

The business went bankrupt and Revenue Canada sued Malcolm for $10,000 for income tax withheld by the company from employee wages but not remitted. The money was used to try to keep the business afloat. The employees are also suing for five months' unpaid wages. Which of the following is true? A) Malcolm is not liable for either claim as he had no involvement with the business. B) Malcolm is not liable for the Revenue Canada claim as he didn't receive any of the money personally. C) Malcolm is liable for the wage claim D) Malcolm is liable for the Revenue Canada claim. E) Both C and D

Sierra Event Planning Services, Inc. records deferred expenses and deferred revenues using alternative treatments. It makes adjusting entries as needed to bring its books to the full accrual basis once a year at the end of the year On December 15, it collected $1,000 from a customer in advance for a series of events that will start late December and end in March. At the end of the year, it had performed approximately 10% of the services for its customer. The adjusting entry on December 31 will include a debit to Service Revenue for $900.

Indicate whether the statement is true or false