Assume you pay a premium of $0.50/bu for a put option with a strike price of $4.00/bu and that the current futures price is $4.25/bu. Then, the option is:

A. In-the-money

B. At-the-money

C. Out-of-the-money

D. None of the above

Ans: C. Out-of-the-money

You might also like to view...

Mac trucks and their dealers would likely have an organizational form of

a. fixed profit sharing franchise contracts b. spot market recontracting c. alliances d. vertical integration

In the last half of 1999, the U.S. unemployment rate was about 4 percent. Historical experience suggests that this is

a. above the natural rate, so real GDP growth was likely low. b. above the natural rate, so real GDP growth was likely high. c. below the natural rate, so real GDP growth was likely low. d. below the natural rate, so real GDP growth was likely high.

Based on the theories of Smith, Ricardo, and Heckscher-Ohlin, in a country with access to cheap labor, productive land, and diverse plant life, it makes sense to _____ agricultural goods

Fill in the blank(s) with the appropriate word(s).

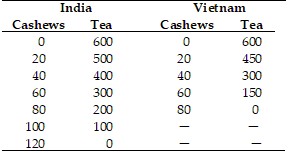

Refer to the information provided in Table 33.5 below to answer the question(s) that follow. Cashews are measured in bushels and tea is measured in pounds (lbs.)

Table 33.5 Refer to Table 33.5. The most that Vietnam will be willing to pay for a bushel of cashews is

Refer to Table 33.5. The most that Vietnam will be willing to pay for a bushel of cashews is

A. 5 lbs. of tea. B. 6.25 lbs. of tea. C. 7.5 lbs. of tea. D. 10 lbs. of tea.