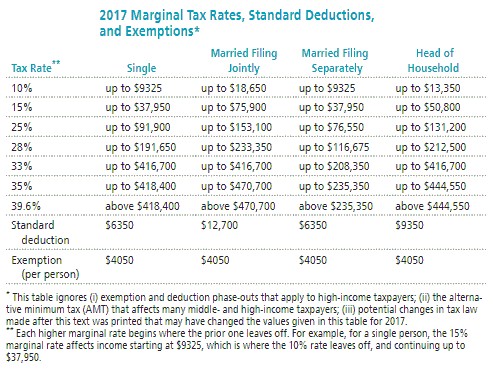

Solve the problem. Refer to the table if necessary. Bill earned wages of

Bill earned wages of  received

received  in interest from a savings account, and contributed

in interest from a savings account, and contributed  to a tax deferred retirement plan. He was entitled to a personal exemption of

to a tax deferred retirement plan. He was entitled to a personal exemption of

style="vertical-align: -4.0px;" /> and had deductions totaling  Find his adjusted gross income.

Find his adjusted gross income.

A. $42,136

B. $53,325

C. $59,451

D. $66,590

Answer: B

You might also like to view...

Solve the problem.Find cos  , given that cos ? = -

, given that cos ? = -  and ? terminates in 90° < ? < 180°.

and ? terminates in 90° < ? < 180°.

A. -

B.

C.

D. -

Complete the identity.sec4 ? - 2 sec2 ? tan2 ? + tan4 ? = ?

A. sec2 ? + tan2 ? B. 2 C. sec2 ? (1 + tan2 ?) D. 1

Solve the problem.If tan ? =  , and ? < ? <

, and ? < ? <  , then find tan 2?.

, then find tan 2?.

A. -

B.

C.

D. -

?To determine an unstated interest rate, divide the future amount by the present value then divide by the number of periods.

Answer the following statement true (T) or false (F)