Thompson Corporation is considering the purchase of a new piece of machinery. Thompson expects the new machinery to increase its revenues by $70,000 at the end of year 1, $60,000 at the end of year 2, and $50,000 at the end of year 3 at which point the

machinery will have exhausted its useful life. If the interest rate is 4%, what is the most Thompson should be willing to pay today for this piece of machinery?

The present value of the future revenues generated by the machinery is $167,230.88 . Thompson should not be willing to pay any more than this for the machinery.

You might also like to view...

The standard of living rises at a faster pace than labor productivity if

A) n = q. B) n < q. C) n > q. D) The standard of living is not affected by the relative size of n and q.

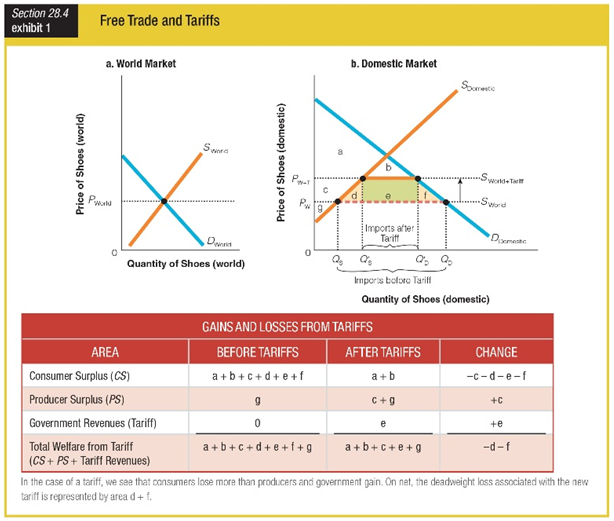

What is the change in total welfare as a result of the tariff on shoes as shown in Exhibit 1?

a. loss of areas d, e, and f

b. loss of areas d and f

c. gain of area e

d. gain of area g

The government subsidizes education because:

A. education is thought to have positive externalities. B. private firms will not provide education. C. it is a pure public good. D. the government can provide a better education than can private firms.

Describe the major sources of revenue and major types of expenditures at each level of government

What will be an ideal response?