Which of the following is false?

A) Special interest legislation is necessarily bad legislation in the sense that it does not (because it cannot) ever benefit the general public.

B) A special interest group is a subset of the general population that holds usually intense preferences for or against a particular government service, activity, or policy.

C) Congressional districts can be thought of as special interest groups for certain purposes.

D) Special interest groups are likely to argue for their specific policies or programs by claiming they serve the best interests of the general public.

A

You might also like to view...

If Ringo is risk averse, at a wealth of $200,000 his utility of wealth curve has a ________ slope and his marginal utility of wealth is ________ than at a wealth of $100,000

A) negative; smaller B) negative; larger C) positive; smaller D) positive; larger

Last year, Casey grew fresh vegetables, which she sold at her local farmers market, but this year, Casey did not plant any vegetables and went to work at a bank instead. Which of the following best explains Casey's career change?

A. Casey's opportunity costs of gardening exceeded Casey's opportunity costs of working at the bank. B. Casey's opportunity costs of working at the bank exceeded Casey's opportunity costs of gardening. C. Casey's opportunity costs of gardening exceeded Casey's benefits from working at the bank. D. Casey's opportunity costs of working at the bank exceeded Casey's benefits from gardening.

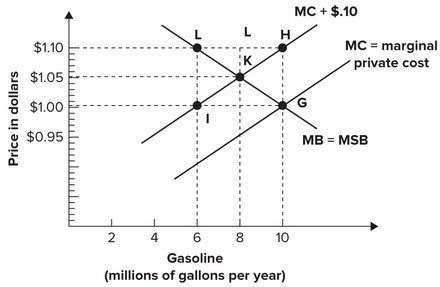

Refer to the graph shown. If the marginal cost external to the trade associated with the use of gasoline is $0.10 per gallon, the point on the graph corresponding to the efficient quantity and price is:

A. K. B. L. C. H. D. G.

Empirical evidence suggests that over the last several decades:

A. there is no correlation between the nominal and real federal funds. B. while the FOMC has had a lot of influence over the nominal federal funds rate, they have been less successful at changing the real federal funds rate. C. the nominal and real federal funds rates are related inversely. D. the nominal and real federal funds rates are highly positively correlated.