Christine is an artist who creates custom cookie jars. Her annual revenue from selling the cookie jars is $90,000 . The annual explicit costs of the materials used to make the cookie jars are $54,000 . Christine could earn $6,000 per year preparing taxes. In calculating the economic profit of her cookie jar business, the $6,000 that Christine gives up is counted as part of her business's

a. total revenue.

b. explicit costs.

c. implicit costs.

d. marginal costs.

c

You might also like to view...

Which of the following statements is false?

a) Income elasticity of demand is positive for inferior products. b) Income elasticity of demand is negative for inferior products. c) Income elasticity of demand is positive for normal goods. d) None of the above.

The Iranian Revolution in 1979 led to another interruption of oil supplies to the United States. This caused the reoccurrence of

A. deflation. B. full employment. C. trade surpluses. D. stagflation.

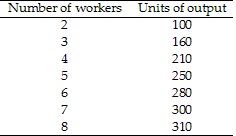

Refer to Table 10.1. If the price of output is $2 per unit and we observe the firm hiring four workers, if the firm is maximizing profit, the wage rate must be between ________ and ________.

Refer to Table 10.1. If the price of output is $2 per unit and we observe the firm hiring four workers, if the firm is maximizing profit, the wage rate must be between ________ and ________.

A. $40; $50 B. $50; $90 C. $80; $100 D. $320; $500

Answer the following statements true (T) or false (F)

1. The policy implication of the long-run Phillips Curve is that, while stimulative policies may work to reduce unemployment in the short run, the only effect of such policies in the long run is to raise inflation. 2. Based on the long-run Phillips Curve, any rate of inflation is compatible in the long run with the natural rate of unemployment. 3. The adjustment mechanism that brings the economy to its long-run aggregate supply has to do with inflation-expectations, whereas the adjustment to the long-run Phillips curve has to do with wage flexibility. 4. Supply-side economists contend that aggregate supply is the relevant policy factor in influencing the price level and real output in an economy. 5. Supply-side economists recommend higher marginal tax rates to increase aggregate supply and real output.