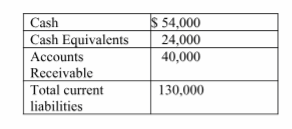

John&'s Food Market had the following financial data at December 31, 2018:

Cash and cash equivalents $ 78,000

Total current liabilities 130,000

a. What is the cash ratio as of December 31, 2018? Show the formula and your computations.

b. Comment on the cash ratio for Metro Construction Company.

a. Cash ratio = (Cash + Cash equivalents)/Total current liabilities

= ($54,000 + $24,000)/$130,000

= 0.6

b. The cash ratio is used to measure a company's ability to meet its short-term obligations. This ratio is the most conservative valuation of liquidity because it only includes cash and cash equivalents. John's cash ratio is less than 1.0. This indicates that they do not have sufficient cash

and cash equivalents to pay current liabilities.

You might also like to view...

An express warranty is a written guarantee that assures the buyer that he or she is getting what he or she has paid for or that provides recourse in case a product's performance falls short of expectations

Indicate whether the statement is true or false

Generally, affirmative action plans must be permanent, may restrict the job opportunities of those not included in the plan, and should involve the hiring or promotion of unqualified workers (since such workers can be trained after their hiring or promotion).

Answer the following statement true (T) or false (F)

The adjusted trial balance facilitates the preparation of the financial statements

Indicate whether the statement is true or false

Which of the following is not one of the distinguishing characteristics of an capitalistic economy

A. Workers decide all questions of policy for their particular business. B. Individuals own a majority of the factors of production. C. The government does not own the businesses that are cornerstones of the economy D. Most economic decisions are made by individuals