On February 1, Alan, a single individual, purchased his first personal residence for $400,000. On July 1, Alan sold this residence for $460,000 because he accepted a new job in another state. Consequently, Alan occupied the home for only 150 days. How much gain must Alan recognize?

A. $51,370

B. $0

C. $8,630

D. $30,000

Answer: C

You might also like to view...

The ________ is often the only portion of the marketing research report that executives read

A) title page B) letter of transmittal C) letter of authorization D) executive summary

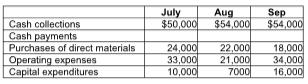

Calculate the projected balance of cash at the end of August.

Berman Company is preparing its budget for the third quarter. Cash balance on July 31 was $34,000.

Assume there is no minimum balance of cash required and no borrowing is undertaken. Additional

budgeted data are provided here:

A) $16,000

B) $104,000

C) $45,000

D) $38,000

In the communication model, the ________ can be any organization or individual that intercepts and interprets a message

A) medium B) receiver C) source D) encoder E) noise source

Describe the doctrine of precedent and its application to common law