The Fed is reluctant to change the required reserve rate because:

A. the money multiplier is not impacted by the required reserve rate.

B. the time lag between changing the required reserve rate and changes in the money supply can be too long.

C. changes in the rate have a small impact on the actual quantity of money.

D. small changes in the required reserve rate can have too big of an impact on the money multiplier and the level of deposits.

Answer: D

You might also like to view...

Which of the following is true for the economy depicted in Figure 9-2?

a. potential output equals y1 b. it would be impossible for this economy to achieve an output greater than y1 c. when output y1 is achieved, the actual rate of unemployment will exceed the natural rate of unemployment d. when output y1 is achieved, the actual rate of unemployment will be less than the natural rate of unemployment

Growth accounting refers to the method used to

A) identify the contribution of economic growth from increased capital, labor, and technological progress. B) measure growth in the capital stock. C) measure the growth in the labor force. D) identify the costs of promises made by the government today but paid for by future generations.

Consider the demand for labor in the computer chip industry. The demand for labor

A) is derived from the demand for computer chips. B) is shown by a perfectly elastic demand for labor. C) is shown by a perfectly inelastic demand for labor. D) has a demand curve that is backward bending.

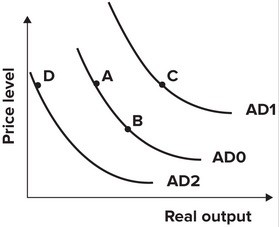

Refer to the graph shown. From 1938 to 1943 the Federal deficit rose from $1.0 billion to $53.8 billion due to increased defense spending. The effect of this on the AD curve can be shown by a movement from:

A. A to B. B. A to C. C. A to D. D. B to A.