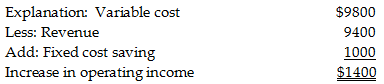

Assume that fixed costs of $1000 could be eliminated if Product B was dropped. Assume furthermore that dropping one product would not impact sales of the other. If Product B is dropped, what would be the impact on total operating income of the company?

A company has two different products that are sold in different markets. Financial data are as follows:

A) increases by $1000

B) increases by $1400

C) increases by $400

D) increases by $2000

B) increases by $1400

You might also like to view...

An indirect cost is one that is directly attributable to the system or the system

Indicate whether the statement is true or false

The new insurance policy for employees ____ each individual to pay more for name-brand drugs

A) require B) requires

Craigmont uses the allowance method to account for uncollectible accounts. Its year-end unadjusted trial balance shows Accounts Receivable of $138,500, allowance for doubtful accounts of $1005 (credit) and sales of $1,095,000. If uncollectible accounts are estimated to be 0.7% of sales, what is the amount of the bad debts expense adjusting entry?

A. $7665 B. $6660 C. $7865 D. $8670 E. $7790

Indicate how each event affects the elements of financial statements. Use the following letters to record your answer in the box shown below each element. Use only one letter for each element. You do not need to enter amounts.Increase = IDecrease = DNo Effect = NSierra Co. issued 10,000 shares of common stock for $45 per share. The stock has a par value of $10.AssetsLiabilitiesEquityRevenuesExpensesNetIncomeCash Flow? ?????

What will be an ideal response?