A . What effect will a tax on cigarettes have on the consumption of cigarettes and on the wallets of smokers who are addicted to cigarettes? b. What effect will a tax on cigarettes have on the decision of teenagers to smoke? c. Describe the cross elasticity between cigarettes and the price of a Nicoderm patch, which is used to fight the craving for nicotine

a . Addicted smokers have an inelastic demand for cigarettes, so they will pay the higher price (hurting

their wallets) and continue to smoke about the same number of cigarettes as before the tax.

b. Since the tax raises the cost of a pack of cigarettes, fewer teenagers will choose to smoke, ceteris

paribus.

c. Cigarettes and Nicoderm patches are substitute goods, so the cross elasticity should be a positive

number.

You might also like to view...

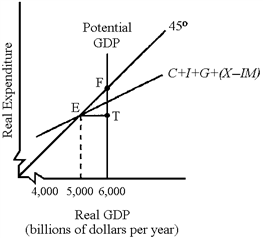

Figure 11-1

?

A. increasing Social Security payments. B. decreasing defense spending. C. decreasing personal income taxes. D. All of the above are correct.

What is the relationship over the business cycle of potential GDP and real GDP?

What will be an ideal response?

Bonnie volunteers to help make floral arrangements at a flower shop. She is an example of

A) entrepreneurial ability. B) labor. C) physical capital. D) human capital.

Growth in employment can result from either an increase in labor supply or an increase in labor demand

a. True b. False