Consider two investors: one is risk-neutral and the other is risk-averse. How do they each assess a risk premium?

What will be an ideal response?

The risk-neutral investor seeks a risk premium that has the price of the bond (and its subsequent yield) such that the price equals the expected value (the sum of the payoffs times the probabilities). The risk-averse investor would offer a price less than this (and therefore seek a higher yield) since he/she requires additional compensation for risk. Therefore, the risk-averse investor's risk premium would be greater.

You might also like to view...

Give an example of an automatic stabilizer. Explain how automatic stabilizers work in the case of recession

What will be an ideal response?

Over the period 1960-2010, the United States economy grew at roughly

A) 2.1 percent. B) 3 percent. C) 4 percent. D) one percent. E) 3.5 percent.

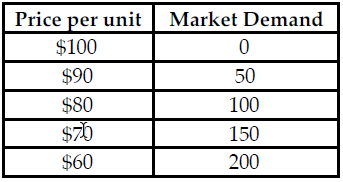

Refer to the table below. If this market is a Cournot Oligopoly and Firm X is produces 50 units, what is Firm Y's demand at a price of $70?

The table above shows the market demand for a product that both Firm X and Firm Y manufacture. Both firms produce an identical product and the firms' average total and marginal cost are equal and constant.

A) 50

B) 0

C) 100

D) 150

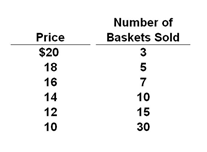

Refer to the table below for Nina. What is the change in total revenue if she lowers the price from $20 to $18?

The table shows the demand schedule facing Nina, a monopolist selling baskets.

A. $10

B. $20

C. $30

D. $40