What is the unit product cost using variable costing?

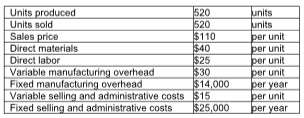

Sequoyah, Inc. reports the following information:

A) $110

B) $92

C) $95

D) $15

C) $95

Total unit product cost:

Direct materials $40

Direct labor 25

Variable manufacturing overhead 30

Total unit product cost $95

You might also like to view...

The FASB has set a hierarchy of inputs to consider in assessing fair value. Which of the following relates to Level 3?

a. Quoted prices for identical items in active, liquid, and visible markets. b. Unobservable inputs to be used in illiquid situations. c. Observable information for similar items in active or inactive markets. d. Unobservable inputs to be used in situations where markets do not exist.

Which of the following products is best suited for distribution through long channels?

A) textiles B) high-end electronic goods C) automobiles D) jewelry

The core employees in the nine-box grid are those with ________.

A. high potential and low performance B. low potential and outstanding performance C. high potential and high performance D. moderate potential and solid performance

Comparing net present value and internal rate of return ________

A) always results in the same ranking of projects B) always results in the same accept-reject decision C) may give different accept-reject decisions D) is only necessary on independent projects