Consider two scenarios for a nation's economic growth. Scenario A has real GDP growing at an average annual rate of 1%; scenario B has an average annual growth of 6%. The nation's real GDP would double in about

A. 72 years under scenario A, versus 18 years under scenario B.

B. 36 years under scenario A, versus 12 years under scenario B.

C. 72 years under scenario A, versus 12 years under scenario B.

D. 36 years under scenario A, versus 9 years under scenario B.

Answer: C

You might also like to view...

Answer the following statement(s) true (T) or false (F)

1. When the law of supply holds, an increase in the price of a product will cause producers to increase the quantity they wish to sell. 2. A rise in supply is illustrated by a rightward shift in the supply curve. 3. The supply curve for a commodity will shift downward when an excise tax is imposed. 4. An increase in the price of wheat will cause a rise in the supply of wheat. 5. When the actual market price is below its equilibrium level, suppliers are satisfied but demanders are not.

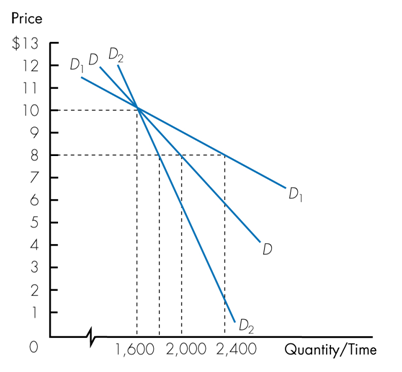

Refer to the following graph. When the price falls from $10 to $8, demand

a. is most elastic if the demand curve is D2.

b. is most elastic if the demand curve is D.

c. is most elastic if the demand curve is D1.

d. is most inelastic if the demand curve is D.

The leading trading partner of the United States is

A) Canada. B) Japan. C) Germany. D) Mexico.

When the required reserve ratio is changed,

a. the money multiplier is changed but the amount of excess reserves in the banking system is unchanged. b. the money multiplier is unchanged but the amount of excess reserves in the banking system is changed. c. the size of the money multiplier and the amount of excess reserves change in the opposite direction from the required reserve ratio. d. the size of the money multiplier and the amount of excess reserves change in the same direction as the required reserve ratio. e. neither the money multiplier nor the amount of excess reserves change.