If the present value equation used to calculate the price of a stock you are considering buying is "[$12 / (0.05 - 0.02)], which of the following is correct, assuming that dividends will grow at a constant rate?

A) The dividend is $12 per share, the dividend growth rate is 2 percent, and the interest rate is 5 percent.

B) The stock price is $12, the dividend growth rate is 5 percent, and the interest rate is 3 percent.

C) The dividend is $12 per share, the dividend growth rate is 5 percent, and the interest rate is 2 percent.

D) The stock price is $12, the dividend growth rate is 2 percent, and the interest rate is 5 percent.

C

You might also like to view...

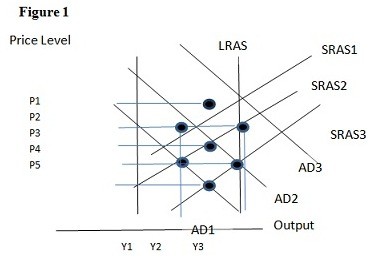

Using Figure 1 above, if the aggregate demand curve shifts from AD3 to AD2 the result in the short run would be:

A. P3 and Y1. B. P2 and Y1. C. P2 and Y3. D. P1 and Y2.

Which of the following is NOT an example of natural monopoly?

A. water systems B. electricity transmission C. local telephone services D. farm products

Deposit insurance shields depositors from the adverse effects of risky decisions and thereby

A. encourages moral hazard on the part of depositors. B. generates a more efficient banking system. C. encourages riskier behavior on the part of managers of depository institutions. D. encourages depositors to monitor the managers of depository institutions more closely.

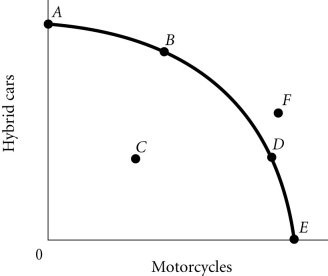

Refer to the information provided in Figure 2.4 below to answer the question(s) that follow. Figure 2.4Refer to Figure 2.4. The economy moves from Point A to Point D. This could be explained by

Figure 2.4Refer to Figure 2.4. The economy moves from Point A to Point D. This could be explained by

A. an increase in economic growth. B. a change in society's preferences for motorcycles versus hybrid cars. C. a reduction in unemployment. D. an improvement in technology.