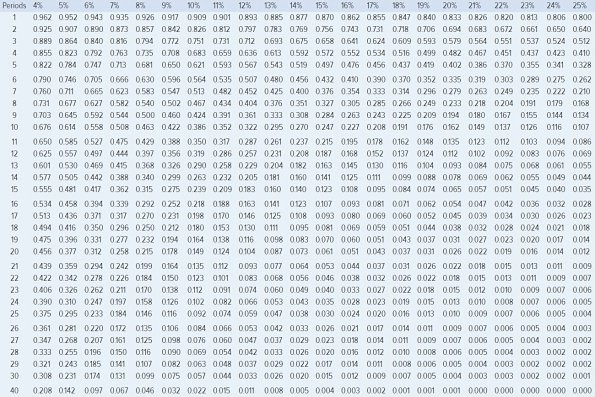

Exhibit 7B-1 Present Value of $1;

Manjarrez Corporation has provided the following information concerning a capital budgeting project: Investment required in equipment$240,000 Expected life of the project 4 Salvage value of equipment$0 Annual sales$560,000 Annual cash operating expenses$430,000 The company's income tax rate is 30% and its after-tax discount rate is 6%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income

Manjarrez Corporation has provided the following information concerning a capital budgeting project: Investment required in equipment$240,000 Expected life of the project 4 Salvage value of equipment$0 Annual sales$560,000 Annual cash operating expenses$430,000 The company's income tax rate is 30% and its after-tax discount rate is 6%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income

taxes into account in its capital budgeting. Use Exhibit 7B-1 to determine the appropriate discount factor(s) using table. The net present value of the entire project is closest to:

A. $196,000

B. $377,685

C. $210,450

D. $137,685

Answer: D

You might also like to view...

The present value of $500,000 received at the end of five years discounted at 10% is

A) $805,255. B) $310,461. C) $306,957. D) none of these

An executory promise, which is valid consideration to support a contract, is also the giving of value to support holder in due course status

a. True b. False Indicate whether the statement is true or false

According to the modern view an assignment of rights implies a delegation of duties unless there is language to the contrary

Indicate whether the statement is true or false

An object class is a set of objects that share a common structure and behavior

Indicate whether the statement is true or false