Most poor families pay _____ federal personal income tax.

A. no

B. a little

C. a substantial part of their incomes in

A. no

You might also like to view...

Horizontal equity means that equally situated individuals should be taxed equally.

Answer the following statement true (T) or false (F)

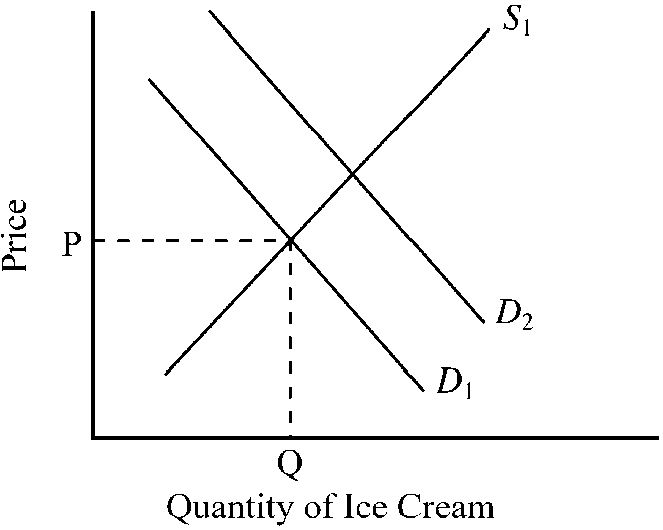

Figure 3-7

In , suppose D1 and S1 indicate the initial conditions in the market for ice cream. Which of the following changes would tend to cause the shift from D1 to D2 in the market for ice cream?

a.

a decrease in the price of sugar, an ingredient used to produce ice cream

b.

an increase in the price of frozen yogurt, a substitute for ice cream

c.

abnormally cold weather that decreased consumer desire for ice cream

d.

an increase in the price of milk, an ingredient used to produce ice cream

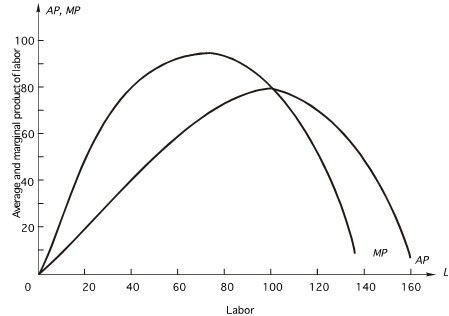

The following graph shows the marginal and average product curves for labor, the firm's only variable input. The monthly wage for labor is $2,800. Fixed cost is $160,000. When the firm uses 120 units of labor, what is average total cost at this output?

When the firm uses 120 units of labor, what is average total cost at this output?

A. $40 B. $84 C. $120 D. $59 E. $190

The equation of exchange always holds because

A. the quantity of money is determined by the amount of spending on goods and services. B. the quantity of money dictates the size of nominal GDP, since money is a social usage. C. MV measures total spending on GDP and PY also measures of total spending on GDP. D. the number of times money is spent to obtain goods and services measures total spending on GDP.